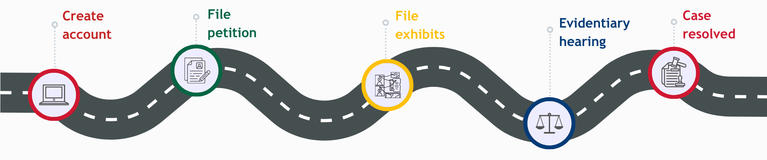

The Appeal Process

The steps below will guide you through the appeal process at the Board of Assessment Appeals (BAA). In brief, a BAA appeal starts with the creation of an online account, and the filing of an electronic petition for appeal. The BAA reviews the petition, and sets accepted appeals for hearing. Except in rare cases, the hearing will not be earlier than four months after the BAA has accepted the petition. The parties exchange proposed exhibits four weeks before the hearing. The BAA holds a hearing and considers the evidence, and then issues a written decision resolving the appeal. It is recommended that you review Instructions for Appealing Property Tax Assessments with the Board of Assessment Appeals for an overview of the appeal process.

Create an account with the BAA’s case management system.

Fill out a petition form.

File hearing exhibits 4 weeks before hearing.

Present evidence and argument.

BAA issues a written Final Agency Order.

Learn more about the BAA's internal appeal process and how the BAA fits into the larger property tax appeal processes by viewing the flowcharts below.