File a Petition for Appeal

After you create an account, you will have the ability to fill out and submit an appeal petition. The petition form will prompt you for the required supporting documentation. You will need to upload a copy of the decision you are appealing. Documents you wish the Board to consider in support of your case, such as comparable sales or other evidence, should not be filed with your petition. They will be due to the Board four weeks before your hearing, under Rule 11 of Board Rules. You will also need to pay any applicable filing fees. The BAA reviews the petition to ensure all required information and documentation is provided. When the petition is accepted, the BAA schedules a hearing date and issues a Notice of Hearing.

Filing an Appeal Resources

- Video Tutorial: How to File an Appeal

- Instructions for Appealing Property Tax Assessments

- How to File an Appeal Petition (Self-Represented Taxpayer)

- How to File an Appeal Petition (Attorney or Tax Representative)

- How to Create and Pay for New Petitions & File Multiple Petitions via CSV

- CSV Template for Bulk Filing of Petitions

- Filing Fees

- Board Rules

- Property Tax Terminology

Do I have to pay for my appeal?

Taxpayers without an attorney pay no fee for the first two petitions filed, and $33.75 for the third and subsequent petitions. Attorneys and agents pay a filing fee of $101.25 for all petitions. These fees are per petition, not schedule number.

Can I still file an appeal even if I don’t have a decision from the County?

If you have not filed an appeal with both your County Assessor and your County Board of Equalization or Board of County Commissioners, you may not file an appeal with the BAA. If you have filed these appeals and have not received a decision, you should state that in your petition.

Who has the option of requesting an accelerated appeal?

By statute, the BAA must advance all appeals from a decision of the Division of Property Taxation on its calendar and give that appeal precedence over other matters pending before the Board. In addition, by statute, a taxpayer’s appeal concerning the valuation of rent-producing commercial real property may be advanced on the BAA’s calendar and will take precedence over other matters if certain statutory preconditions are met and a $200 filing fee paid. All other appeals are scheduled per the BAA’s normal procedures.

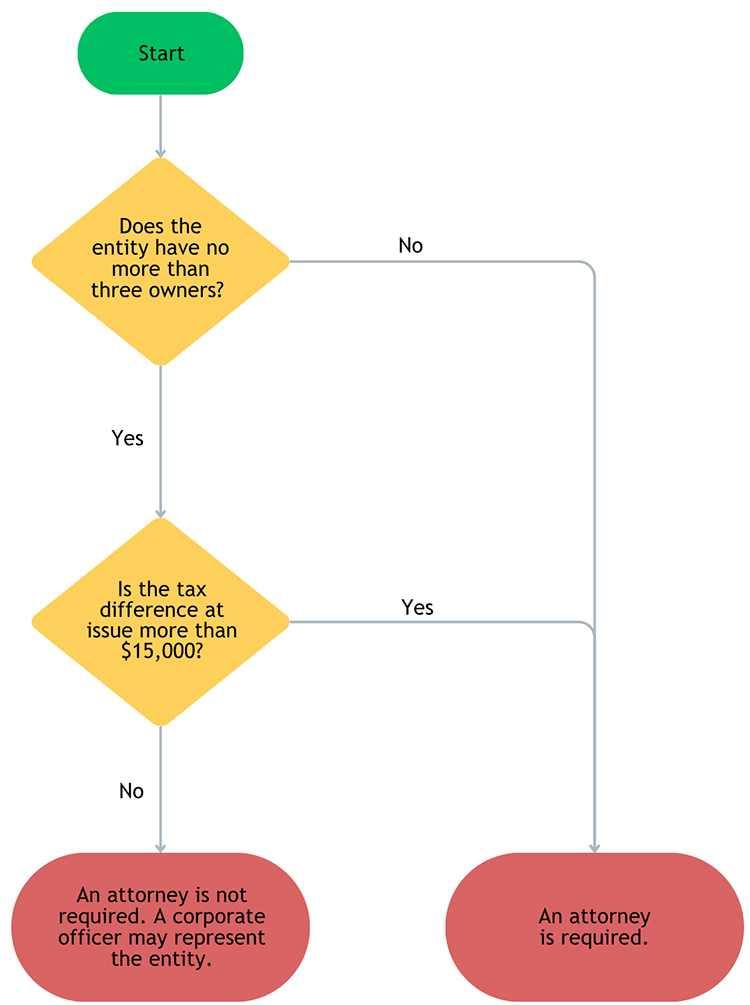

When Does An Entity Petitioner Need an Attorney?

Business entities must be represented by an attorney, unless they are closely held (three or fewer owners) and the amount in controversy is $15,000 or less, in which case they may be represented by an officer of the entity. See Section 13-1-127, C.R.S.